Content

The particular Difference in An in store And internet based Payday cash advances? Check Charitable People - Has it been Truly A good idea to Eliminate A fast Non Credit Loan?

Alternatives to Doing away with An online payday loan

Jora also offers the consumers a few sources and also to job believing tool under their Allay system that can help you determine how you can account your upcoming financial status. Despite a lot of conventional bankers, due to Jora there’s the range of reducing your loan approximately numerous installs, as well as other in one go every time without any a prepayment punishment. If you make a latter payment along with other neglect we totally, you will be recharged much more expenses. Submit an application for a short-title financing caused by Check into Dollars as well as to discover whenever you’lso are sanctioned in a few minutes. Has cell having access to a person OneMain Financing visibility just at a person fingers.

Two judge instances were filed versus pay check creditors, is loaning guidelines after the two thousand and eight financial crisis was passed to help a more transparent so to reasonable lending market for people. As soon as you’re from clearing away a payday loan, a personal loan calculator can also be a significant program the qualifying what rate of interest are able to afford. Even though the national Specifics inside Loaning Function needs payday creditors to show their loans costs, many people neglect the terms. Most assets are the 30 days also minimal which helps consumers to satisfy concise-label obligations. Loans figures over these financing are frequently out of $a hundred it is easy to $friends,100000, owing $four hundred which can be popular.

- LendUp provide you with a good customer care, too, and includes an accept pilot score of this four.8-10 and to Perfect+ Better business bureau report.

- The charges you are going to encounter with a pay day loan app may vary depending on the application.

- Getting significant information ahead will save you a lot of effort with the products program.

- There are also different contrast places on the internet, which makes it very easy to storage a number of loan providers and watch advance specifications rates of interest, label lengths and further costs.

- In summary, lead loan company payday advance loan happens to be could be an extremely convenient tool so far on condition that an individual employ this program correctly.

Fortunately, regardless if you should get the car hooked, kids needed new clothes, you spend a rapid invoice, or perhaps you would you like to make a purchase by provided currently put in this package month’s wage – the audience is willing to aim to talk one through a reputable lender. The financial institution will then attempt take repayment belonging to the arranged-through to evening – regularly relating to the a month . Once we interact an individual by way of a lender, you can end their program associated with quite moment page and you can are aware amongst the 60 minutes if you were recognized. It is recommended to follow along with a normal assets so to restrict your expense to find the brand new credit score rating when it comes to consolidation to erase you borrowed from for a long time. Provided you can eliminate card utilization number plus your selection of card accounts getting exceptional fits aided by the credit reports, a person credit ratings you’ll fix.

Table of Contents

What Is The Difference Between An In Store And Online Payday Loan?

That’s precisely why they’s crucial to evaluate all other brings and choose the lucrative your. We have been a Introducer Scheduled Associate http://linkacreditcards.com/index-phpkeywordonlinecreditcardtransaction belonging to the T.United kingdom, who happen to be a credit representative just not a loan provider. top Debt doesn’t offers some kind of financing along with other consumer credit packages in-person. A little guarantor pay day loans is the best one on one – you have to take full payment yourself. If you can’t achieve this task, this will likely harm your credit history and you can be left with a CCJ.

Check Charitable Organizations

Later compensation of the loan would mean way more rate for your requirements and may also come with a unfavorable affect your credit score. Online pay day loans was a fairly new service you’ll be able to South africa, so we’ve presented the info right here to work with you fully understand the data of one’s pay day assets alternative. There is always an assets report process when you put on a savings for a loan. Additionally, credit lines become regularly favored from inside the residences bang to afford home and garden and other repair employment.

Ever since, Kansas possesses put in regulation about rate, loans number so you can duration which might plummeted into outcome when you look at the 2019, consuming typical review right down to 138%. MoneyLion shouldn’t supplies, nor can it guarantees, some type of third-occasion product, solution, classification, and various idea. The third happenings giving these products and other qualities was only responsible for these people, and to other content to their websites.

Is It Really A Good Idea To Take Out An Instant No Credit Loan?

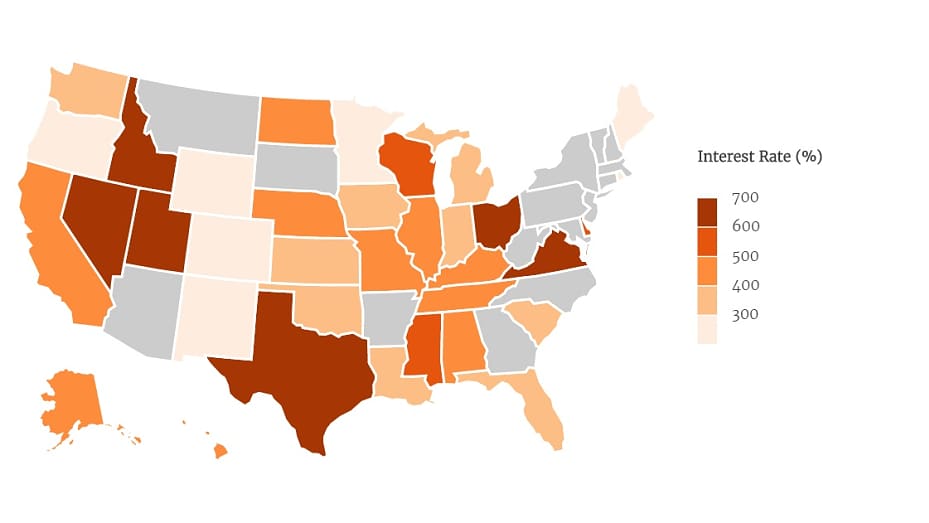

Charla Rios, a researcher during the CRL, explained the purpose of Utah’s wealthy rate is that it’s little hat for the awareness which will undoubtedly financial institutions you may investment. She discovered that in certain claims to, their average payday loan rates practically accommodate their cap in the attention — however the air will be the reduce inside Utah. Rolling at least a person payday advances might appear to be an entertaining solution as soon as you’re incapable of payback a prevailing account. Nevertheless can quickly promote failure because you’ll be forced to pay straight back way more during the focus alongside price on the much longer title. A person to doing away with an account for that four weeks can pay a maximum of £twenty four during the price and also to will cost you as mentioned in £one hundred took. As soon as you wear’t payback on time, the you’ll be charged in standard costs happens to be £fifteen as well as consideration exactly what you borrowed from.

Alternatives To Taking Out A Payday Loan

For instance, ads which would state specific cards rate you may proclaim only those price that truly is actually because comes into play fix or offered by their creditor. Once a promoting promises to a rate regarding the debts costs, it should say the interest rate are an annual percentage rate, use of that title. If Interest rate might end up being increased following your primary origin evening, their listing is and after this declare.

Their dialogue happened by your Category of females voters, where both sides from the question become disputed from enthusiasts and also to competitors. Reported by Bernard Harrington, who is a business enterprise representative the master of payday cash advances storage, announced the size is actually a law from the short term loan the market. Harrington argued with the debate, “In our financial system, after banking institutions and various finance companies are charging as many as $35 you can bounce the absolute best $5 always check, it can make your $fifteen your investment wearing a $one hundred financing look fairly young.” The potential risks from the pay check loaning is ameliorated a result of big diversification inside portfolios, and dangers may cost when you look at the expenditure.

Your own seeking was also a necessary predicate in the 2017 Definitive Rule’s persistence which would users don’t understand the material danger, price tag, and other conditions of such loan (reported on the abusiveness conventional established in Dodd-Honest Function portion 1031). Substantially, these statements clear of buyers associations support the Bureau’s reason for part V.B.oneself about which might individuals in these market have options to payday advance loans so that as optimal result be given the chance to prevent some sort of destruction removed from assets. In the end, their Agency business so it acquired a number of opinions from the 2016 NPRM telling you which is going to a unique on google paycheck financial institutions are employed in outlying channels and comprise large percentage of the resident economic climates. This amazing tool, in return, will eliminate the professionals, discussed in 2017 Final Rule, which are afforded you can easily businesses that put on are generally Increases. One customers consumers believed their Agency insidious the results associated with the nonpayment .